easyfinancial Services Launched the New #BetterTomorrows Campaign

Grace Mahas — September 11, 2019 — Marketing

References: easyfinancial & linkedin

According to a recent study, over 7 million Canadians do not have prime credit scores, and in an effort to ensure Canadians can feel more financially secure in the event of an emergency, easyfinancial service has launched the new #BetterTomorrows campaign.

The #BetterTomorrows campaign was done in partnership with creative agency Arrivals + Departures to underscore the benefits of having financial relief. The storytelling commercial tells the narrative in reverse chronological order of a young woman being accepted to university thanks to the science-focused presents gifted to her by her parents at a young age.

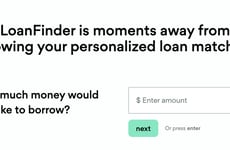

The #BetterTomorrows campaign highlights the fact that "never know what tomorrow might bring," however, the financial company can help prepare individuals with loans of up to $35,000 CA.

The #BetterTomorrows campaign was done in partnership with creative agency Arrivals + Departures to underscore the benefits of having financial relief. The storytelling commercial tells the narrative in reverse chronological order of a young woman being accepted to university thanks to the science-focused presents gifted to her by her parents at a young age.

The #BetterTomorrows campaign highlights the fact that "never know what tomorrow might bring," however, the financial company can help prepare individuals with loans of up to $35,000 CA.

Trend Themes

1. Fintech Services for Non-prime Borrowers - There is a growing trend in providing financial services, such as loans, to individuals with non-prime credit scores, creating opportunities for FinTech companies to cater to this underserved market.

2. Reversal Narrative Storytelling in Advertisements - The use of reverse chronological order in storytelling advertisements is a trend that captures viewers' attention and creates a memorable impact, which can be leveraged by creative agencies and marketers.

3. Promoting Financial Security for Unexpected Emergencies - With an increasing focus on financial security, there is a trend towards campaigns that highlight the importance of being prepared for unforeseen circumstances, presenting opportunities for financial institutions to offer solutions like emergency loans.

Industry Implications

1. Fintech - This trend presents a disruptive innovation opportunity for the FinTech industry to develop innovative loan products and services specifically tailored to non-prime borrowers.

2. Advertising and Marketing - The trend of reverse narrative storytelling in advertisements opens up disruptive innovation opportunities for creative agencies and marketers to captivate audiences and leave a lasting impression.

3. Financial Services - The focus on promoting financial security for unexpected emergencies creates an opportunity for financial institutions to innovate and offer tailored solutions, such as emergency loans or financial planning services.

1.1

Score

Popularity

Activity

Freshness