Cheaper Lending and Borrowing Without Banks!

Trend Spotter — May 2, 2006 — Business

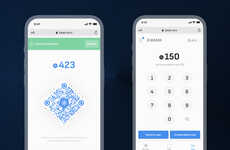

Disintermediation is a term you'll no doubt have heard and will certainly be hearing a lot more in the future. It means “to remove the middle manâ€, and it's something the internet is incredibly good at. With close to a billion people connecting to the internet in the last decade, and computer-mediated anything just a few minutes of Googling away, radical new ideas can promulgate very quickly. And here's one you're gonna love : think of it as P2P money. Zopa hooks up creditworthy people who want to borrow money with people who are happy to lend it to them. And because there's no middleman (e.g. bank), the borrower just pays a 1% exchange fee upfront. Without the greed and inefficiency of a financial institutuion, both borrower and lender get a better deal than they would otherwise.

For borrowers, the money is cheaper. For lenders, there are no fees, better returns and the facility to manage the risk and seek even higher returns.

If there were a popularity poll for organizations, banks and most other financial institutions would rate towards the bottom of the list, somewhere between monopoly Telcos and the Royal Institute of Executioners – which is why we think Zopa's new angle on democratising the lending of money makes so much sense and will garner such a favourable reaction from so many people.

For borrowers, the money is cheaper. For lenders, there are no fees, better returns and the facility to manage the risk and seek even higher returns.

If there were a popularity poll for organizations, banks and most other financial institutions would rate towards the bottom of the list, somewhere between monopoly Telcos and the Royal Institute of Executioners – which is why we think Zopa's new angle on democratising the lending of money makes so much sense and will garner such a favourable reaction from so many people.

Trend Themes

1. P2P Lending - The disintermediation trend allows for the growth of peer-to-peer lending platforms, which benefit both lenders and borrowers through lower fees and better returns.

2. Crowdfunding - The rise of P2P lending also paved the way for crowdfunding, allowing individuals and businesses to access capital directly from a community of backers.

3. Digital Disruption - The shift towards digital solutions for financial services represents a disruption to traditional banking models and presents opportunities for new players.

Industry Implications

1. Financial Technology - The disintermediation trend in finance has created opportunities for fintech companies to disrupt traditional banking services.

2. Alternative Lending - P2P lending and crowdfunding represent a growing industry of alternative lending options that offer better rates and terms to borrowers.

3. Online Marketplace - Platforms like Zopa have created an online marketplace for borrowers and lenders to connect directly, cutting out the middleman of traditional financial institutions.

2.6

Score

Popularity

Activity

Freshness