Fifth Third Bankcorp Offers Drive-Through Financial Services

Josh Thompson-Persaud — May 18, 2021 — Business

References: wsj

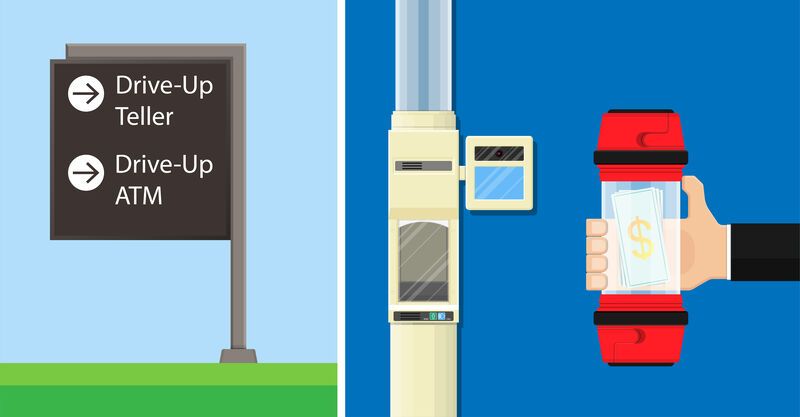

Responding to the health pressures of the pandemic, Fifth Third Bancorp made effective use of drive-through banking windows to offer customers a safe way to receive financial services. The drive-through banking operation covered a range of services centered around common banking transactions. Drawing on age-old technology, the drive-through windows uses a pneumatic tube system to securely exchange financial materials.

The revived initiative arrived at an important juncture for the bank as in-person services were limited or canceled because of the constraints of the pandemic. Drive-through banking brings the in-person banking experience to those who prefer face-to-face interactions and the assurance of an experienced bank teller. Despite pandemic restrictions beginning to recede, drive-through banking offers customers a fast and convenient option for getting more involved financial help.

Image Credit: Shutterstock

The revived initiative arrived at an important juncture for the bank as in-person services were limited or canceled because of the constraints of the pandemic. Drive-through banking brings the in-person banking experience to those who prefer face-to-face interactions and the assurance of an experienced bank teller. Despite pandemic restrictions beginning to recede, drive-through banking offers customers a fast and convenient option for getting more involved financial help.

Image Credit: Shutterstock

Trend Themes

1. Drive-through Financial Services - Other financial institutions can adopt a similar drive-through banking approach to offer customers a safe and efficient banking experience while complying with pandemic restrictions.

2. Contactless Banking - Offering contactless banking services such as mobile banking apps and online financial education resources can help banks attract younger and more tech-savvy customers who want to avoid in-person interactions and prefer digital options.

3. Pneumatic Tube System - Innovating the pneumatic tube system technology with more advanced and secure features can enhance the speed and accuracy of drive-through banking transactions, improving customer experience and loyalty.

Industry Implications

1. Banking - Banks can transform their services and differentiate themselves by leveraging technology to offer contactless banking options, such as mobile banking and online education, to attract and retain customers.

2. Automotive - Collaborating with the automotive industry to design and build custom banking kiosks that enhance the drive-through banking experience for customers can offer a disruptive innovation opportunity for banks to differentiate themselves among their competitors.

3. Retail - Integrating banking services with retail stores, such as offering drive-through banking services at retail locations, can create a one-stop shop experience for customers and help banks increase their market share and expand their customer base.

2.1

Score

Popularity

Activity

Freshness